Company Salary or Dividend

In many small companies, the owners are also the directors, and this gives importance to how income is extracted from the company.

As a director shareholder, there are two core ways to pay yourself; a salary by virtue of you being a director and dividends as a shareholder. It is common to pay a smaller salary and then top up your income by the declaration of a dividend and this has for many years been a strategy adopted by many small businesses.

Where profits are retained within a company, the situation is governed by the corporation tax rules, but when you draw profit out, income tax rules take over, and national insurance rears its ugly head when salaries are involved.

Whether to pay yourself dividend or salary will depend on your level of income, the tax bracket you fall into and your circumstance, but for many people paying a combination of dividends and salary is the most tax efficient way to take money out of a company business.

The main current considerations for choosing between salary and dividends are:

Corporation Tax

This is charged on the profits of the business after taking into account all salaries. Paying a salary reduces profits and hence reduces the corporation tax bill, and dividends can only be paid out after accounting for corporation tax.

Income Tax

Income tax is chargeable on income withdrawn from a company. On a salary, it is collected via the PAYE system at source. Salaries are taxed at the standard income tax rates with an individual being entitled to a tax-free personal allowance, currently £12,570 in the 2021/22 tax year, then 20% in the basic rate band, 40% in the higher rate band between £50,270-£150,000, and 45% for additional rate taxpayers earning above £150,000.

Dividends are taxed personally on the amount paid out by the company. The first £2,000 of dividend is taxed at 0%, with the balance taxed at 7.5% in the basic rate band, 32.5% in the higher rate band and 38.1% for additional rate taxpayers.

National Insurance Contributions

National insurance contributions are payable on salaries, but not on dividends. There are two elements - employee contributions and employer contributions. Employees pay 12% on earnings between the primary earnings threshold of £9,568 for 2021/22 and the upper earnings limit currently of £50,270, and 2% on earnings above this without any upper limit. Employers pay 13.8% on all salaries above the secondary NI threshold, which is currently £8,840 for 2021/22 without any upper limit.

Earnings between the lower earnings limit of £6,240 and the secondary threshold are not subject to NIC but entitle the employee a credit for state pension purposes and for certain benefits.

Employment allowance

Most small businesses, and all charities and CASCs are entitled to an annual 'employment allowance' of £4,000 to reduce their liability for employer’s Class 1 secondary national insurance contributions where there is more than one employee. Only one claim can be made for companies in a group or under common control. Companies with a single paid employee who is also a director are not permitted to claim.

Company law

Salaries can be paid even when a company is making a loss. Dividends can only be paid out of profits after accounting for tax, or any undistributed profits from previous periods. It is important to ensure that the appropriate documentation and minutes are raised to support dividend payments to ensure that they are declared legally and correctly.

Other shareholders

Salaries can be allocated to different directors at any rate. Shareholders are entitled to dividends in proportion to the number of shares held. This means that non-working shareholders would participate in any dividend declared. This lack of flexibility can be countered by creating different classes of share with different dividend entitlements.

Cashflow

PAYE and national insurance are payable monthly; corporation tax is payable nine months and one day after the company's year end with the exception of a large company which will pay its corporation tax by quarterly instalments. Additional income tax on dividends is payable on 31 January after the end of the tax year in which the dividend is paid (payments on account may be required).

Example

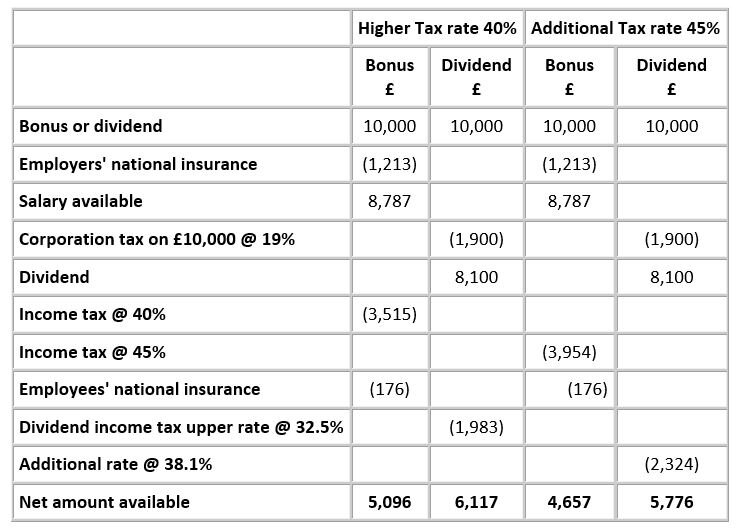

The details below illustrate the potential advantage of using dividends rather than a salary bonus to extract profits of £10,000 from a small company. The examples assume that the directors are already being paid salaries that take them into either the higher rate of income tax (40%) or the additional rate of income tax (45%). As this is above the national insurance normal upper limit, employees' contributions at 2% and employers' contributions will be payable.

This example shows an overall saving of £1,021 (40%) or £1,119 (45%) by paying a dividend because the £2,000 nil-rate band is available to use against the dividend.

Scotland: Rates of 41% and 46% apply so this marginally reduces the overall saving.

If more than £2,000 of dividends have been paid already, this changes the position quite significantly; the income tax charge for the higher rate taxpayer becomes £2,633, leaving the dividend better by £371, and for the additional rate taxpayers the corresponding figures are £3,087 and £357.

Care and professional advice should be taken in all cases. An individual's and company's specific circumstances must be reviewed and the advice tailored to the particular needs.

It is clear that many factors must be considered when deciding whether directors should be paid by dividend or salary/bonus. In practice, a mixture of each is usually the best course, subject to the impact of 'IR35'.